when will i receive my unemployment tax refund 2021

11 2021 Published 106 pm. ANCHOR payments will be.

Just Got My Unemployment Tax Refund R Irs

Unfortunately an expected income tax refund is property.

. The IRS has sent 87 million unemployment compensation refunds so far. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed. There are two options to access your account information.

WASHINGTON To help taxpayers the Internal Revenue Service. I received a federal tax refund for my 2019 tax return by mail dated 61821 Total amt of fed refund ck was 709011 which included 26911 in interest because they took forever. Account Services or Guest Services.

If you use Account Services. If you received unemployment benefits in 2020 a tax refund may be on its way to you. IRS to recalculate taxes on unemployment benefits.

IR-2021-151 July 13 2021 WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers. The IRS might seize. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

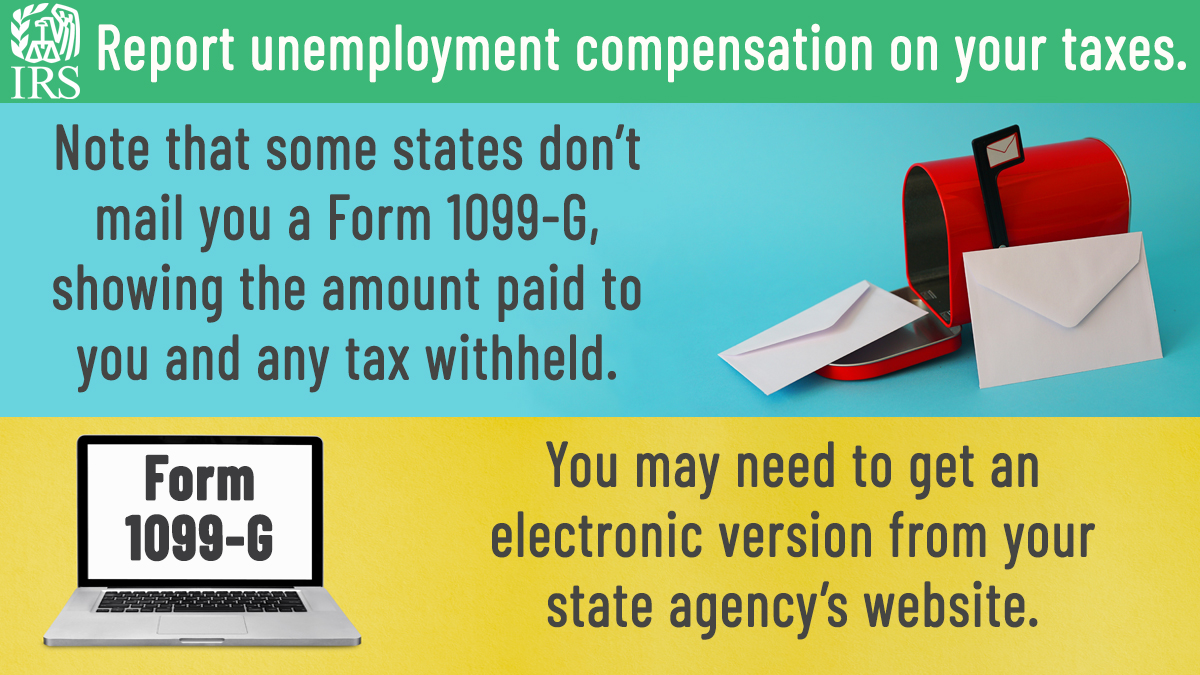

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. The deadline for filing your ANCHOR benefit application is December 30 2022. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income.

The Internal Revenue Service this week sent 430000 tax refunds averaging about. We will begin paying ANCHOR benefits in the late Spring of 2023. We will mail checks to qualified applicants.

If you paid taxes on unemployment benefits received in 2020 you might get a refund or the IRS could seize it. You are also required to pay as much to unsecured creditors as they would receive in a Chapter 7 bankruptcy. You may check the status of your refund using self-service.

Refunds to start in MayIR-2021-71 March 31 2021. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer.

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Irs Issues New Batch Of 1 5 Million Unemployment Refunds

2020 Unemployment Tax Break H R Block

You Could Be Receiving An Unemployment Tax Refund From The Irs

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Irsnews On Twitter If You Received Unemployment Compensation During The Year You Must Include It In Gross Income On Your Irs Tax Return See Details At Https T Co Lhsbya2bvu Https T Co Vfio1irxik Twitter

Irs Unemployment Tax Refund Update Direct Deposits Coming

/do0bihdskp9dy.cloudfront.net/08-16-2021/t_16d2bdaea752464ba461e97da4586a14_name_t_2da645698e8740ac9bdbc41b3b786af0_name_file_1920x1080_5400_v4_.jpg)

Watch Irs To Send More Unemployment Tax Refund Checks

Waiting For Your Tax Refund Here S How To Track The Status Of Your Payment Mlive Com

Anyone Have A June 14 2021 Update Does Anyone Know And Estimate Of How Much I Will Get Back From Unemployment Tax Refund R Irs

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Is Unemployment Taxed H R Block

Covid 19 Unemployment Tax Withholding

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Irs Will Issue Special Tax Refunds To Some Unemployed Money